Avoid The 30% Tax Witholding For Non-US Amazon Sellers

When it comes to US Tax Law, a lot can be really confusing. Putting it simply, the law requires companies such as Amazon to withhold 30% of any non-US sellers royalties.

If you are an American, then there is really no point in reading this article. However, if you are not an America and have just got accepted to the Merch by Amazon program, you have probably just filled out the tax form and got hit with Amazon automatically keeping 30% of your earnings for tax purposes. Keep in mind that this is not the portion of each shirt that Amazon keeps (base cost + 15%), but 30% of your total royalties that you have earned that you will never see.

This can be really disheartening that you will automatically be losing an extra 30% of your hard earned money after you put in so much work designing and selling those designs on Merch by Amazon.

The direct way to avoid this is to create an LLC for non-US residents. But if you don’t plan on doing that, depending on what country you are from, there is actually a few steps that you can do to actually decrease this tax on you, and sometimes can completely remove it from your account.

This means you make more money, which is what we are all about!

What You Will Learn

- What countries are eligible for reduced Amazon tax withholdings

- What an EIN is and why you need one

- 5 Steps to get your EIN to reduce your tax

Now, before we begin, I AM an American but being in the position that we are in, many of our friends and Merch Informer users are from other countries and have had to deal with this tax. The below steps are what they had to go through in order to save those thousands of dollars that would have otherwise been lost. Please also note that I am not an accountant, financial planner, lawyer, or tax man. If you have any specific questions about how to go and pay taxes on the royalties you receive, I highly recommend that you talk to a trained professional such as an accountant.

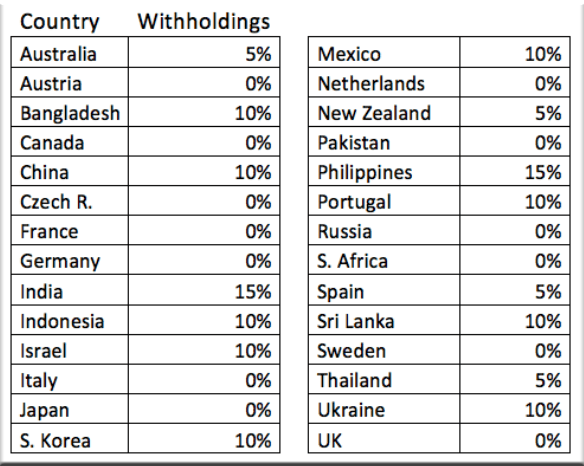

Tax Withholding Rate – Country List

If you want to figure out if you are eligible to reduce the US tax withholdings, you need to know that it depends on where you live, where your company is registered, and what tax treaty your country has with the USA. The above picture shows some of the countries and what their withholdings are based on the tax treaty with the USA that is in place. It does NOT matter what nationality you are when looking at this image. What matters is where your business is located or where you live.

As an example, if Cory was a Mercher who was an American but was currently living in Portugal, he would have to pay the Portugal 10%. That being said, if he set up his own company in the USA, he would be able to not pay any taxes and save that 10% tax withholding saving him thousands of dollars on his royalties. The full list of countries on the IRS (internal revenue service), can be found here: https://www.irs.gov/businesses/international-businesses/united-states-income-tax-treaties-a-to-z.

EIN?

Now that you have taken a look at the above image, you will know if you are eligible or not. If you are, we need to make sure you get a particular tax number called an EIN or Employer Identification Number. You may have also heard of getting an ITIN or an Individual Tax Identification Number but the process of getting one of these requires lots of time, lots of phone calls and is generally just a massive headache.

The American IRS views people who sell on Amazon as small business owners and thus, you can get an EIN. The best part about it, is you can get one from your house without making too much effort.

Quick Note: As of 2017, instead of the following steps we are going to go over, you may be able to use your local tax number when filling out the Amazon forms. This should work for most countries, but there are still some cases where you will need to call the IRS to get your EIN. If this is something you need to do, please follow the instructions below.

Getting Rid Of The Tax Holding: How To Get An EIN

The first thing you need to do is get your EIN number. Fortunatly for you, this is actually a really easy process. You simply need to phone up the IRS and ask them for your EIN number.

Step 1: Call the IRS

A few years ago, you used to be able to fill out a form online but since that has changed in the past few years (requiring a social security number (SSN), or an ITIN), the best way to get around this is simply by calling them.

IRS Phone Number: (1) 267-941-1000

If you want to make this as painless as possible call them at the beginning of their shift when they open. The office hours are 7am-10pm eastern time so give them a call right when they open and you should get right through.

Step 2: Give Information

When you call, you will need to give the IRS some basic information about yourself. They will ask for your first and last name, your address, and sometimes your company if you operate one. If you do operate a company, let them know what your company does.

Step 3: Phone Call Reason

Finally, they will ask you for the reason for your call. Here are two reasons that you could give them:

- I just recently started a merchandise account with Amazon.com and I need to comply with the IRS withholding regulations.

- I need an EIN number to comply with IRS withholding regulations.

Either of these should work as they are true, short, and simple.

Finally, they will ask you some questions about running a company in the US (do you operate heavy machinery?). The answer here is clearly No. Answer the questions truthfully.

Step 4: Grab Your EIN Number

Now that you have answered their questions, they will provide you with your EIN number. Make sure to write this down and you should be good to go. As soon as the IRS gives you an EIN, you can begin using it right away but it can take some time before the IRS updates their own information to reflect the EIN that they have provided you.

Step 5: Update Your Amazon Tax Information

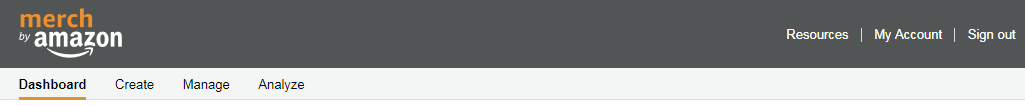

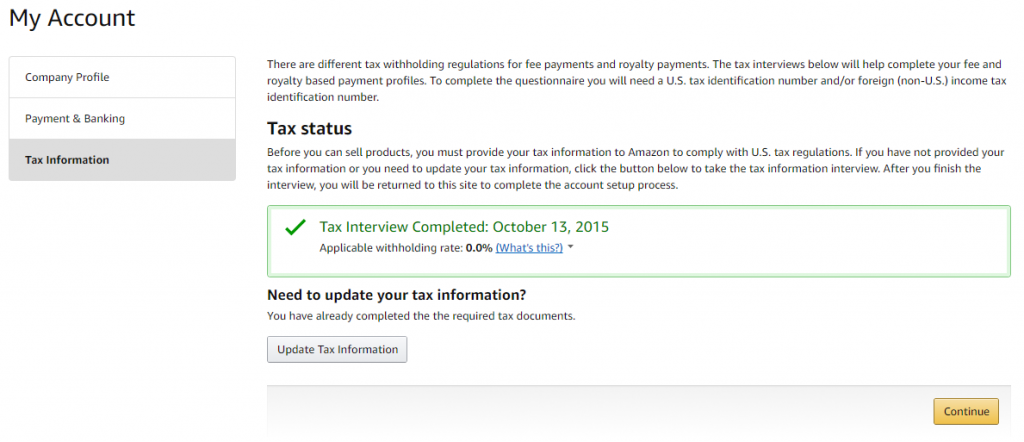

To get to your Merch by Amazon tax information, follow these steps.

First, go to your account and click on “My Account” in the upper right hand corner.

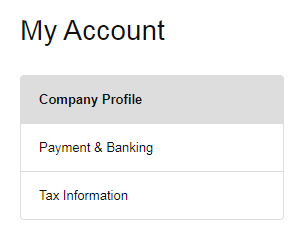

Next, click on your tax information.

From your tax information page, you should see something that looks like this:

Click on “Update Tax Information” and go through the interview.

When they ask if you have a US EIN, click on yes and fill it out with the EIN number the IRS just gave to you. Click on submit for the form and you should be good to go.

Note: It may be possible that Amazon sends you an email saying the IRS records did not match. This is because the IRS takes about a month to update their information. If you get this email, simply wait a few weeks and then do the tax forms over again with your EIN and your witholding rate should be reduced.

Final Tips for MBA Sellers

There are so many people out there that rely on asking Facebook groups questions about taxes or just trying to do them themselves. This is a real business and you need to treat it as one. You need to find an accountant locally where you live that can help you with your taxes.

When they ask you what you do, do NOT tell them that you sell t-shirts on Amazon. It is actually Amazon that sells the shirts and they pay you a royalty. When they ask, say that you receive royalties from Amazon and then they will know how to report those correctly on your local taxes.

Finally, if you decided to switch over from a personal EIN to selling your shirts as a company, you will need to go through a different process. A company can have an EIN as well, but when you apply for that one, it will be your company that is requesting the EIN. This will require another phone call to the IRS and once you receive that EIN, you will need to then go back through and update your Amazon tax information. If you ever decided to change your company name, you will also have to call the IRS and change the tax information in your accounts as well.

Essentially if you restructure or rename, you will need to update your account information as well as call the IRS.

Before I close this out, please contact a local tax accountant. I am not a lawyer, or an accountant and simply sharing information that has been passed on to me.

Good luck, and enjoy your extra royalties in your bank! Until next time, keep selling merch!

Do we need to choose that “we are a US-Person”.

I choose I am a US-Person and i have EIN for a long time but it did not work. Btw i am living in Turkey for last 2 years.

Unfortunately, it is not clear from your blog post. You might explain it in more detail with step by step approach for tax interview. It would be much better.

Just Spoke with the IRS as a Canadain and the asking to sent W7 form and some other ID A long way until you will get the ITIN Number

This only works if you select that you are a business and not an individual. Additionally you need to have a US address that is not a post office box. Then you can enter a EIN, otherwise you will not be able to enter the number as Amazon requires a ITFN

I recently called and got the EIN number, but I think it no works, there is no section to fill out the EIN, only TIN number, also my country is not in the treaty with the United States and clearly a sign says that it does not qualify for the reduction 30% even putting the number EIN as TIN number, due to this i don’t update the tax interview. Is there someone who could reduce the 30% retention by filling the EIN and being your country out of the list of treaties with the United States?

As an individual has anyone from Canada tried just using their SIN number (SSN for americans) instead of the EIN when it comes to the tax forms.

nevermind I tried this straight after I posted it and it worked well.

Hi Neil. Need your advise. My country is NON TAX TREATIES with USA. My country is not in the list. Can this method of getting EIN helps to remove the tax withhold by Amazon?

Will there be any method to help those who are non tax treaty with USA and still get exempted from tax withholding. Many thanks!

If there is no tax treaty at all, you will more than likely not have anyway to lower the tax that Amazon is removing from your monthly payout.

Hi Neil. I just turned 18 which is the age of majority in my country. I’m confused as to what I have to do. I’ve already applied for MBA. The tax treaty says that the Philippines is 15%. Do I just get a TIN no. here in my country or do I still have to get an EIN? I’m an individual and not a business.

If the tax treaty is 15% and that is what your Merch Dashboard says after filling out the tax questionnaire, you should be good to go.

Hi Neil,

My country is not in the list but I still applied for an EIN and gave that to amazon. They said the applicable withholding rate is 0%. ( I am vietnamese). Is this wrong? Can I still keep it 0% or I have to take the interview again?

I followed this step by step and it worked fantastically! Thank you by a huge amount! 30% no longer being withheld due to your post. Thank you Neil! For those in Canada like me, the EIN number is like this xx-xxxxxxx. The IRS operators are mildly retarded but they get the job done.

Hi Neil…

Thanks for the detailed article…

I am from India…I applied to MBA long ago and forgot…now I got an email from MBA asking to update account details…I was very happy but it was for short period…

After seeing all tax details they are asking I totally confused and started to search on the web for any info…

I got some info about Payoneer and I did that…I think it is only a payment method to receive my royalties and nothing related to tax information?!

Is there any other way to do this ?

Can we do it by asking someone to call on behalf of me? I am worried about the Call cost…and also the process and all details !!

suggest me if you have any other alternative ways?

If I am okay with tax withholding rate of 30%…can I skip calling IRS and all the process?

I think some of my questions make you laugh, but I am confused 🙂

Thanks,

Ravi.

Just make the call and follow the article. You will be okay, I promise!

Hi,

Just to clarify as a UK citizen still living in the UK and have never visited the US, I can apply for a US EIN and not have to pay the any of the 30% holding rate?

cheers

Correct!

Hello Neil

I have recently found an American lady on Fiverr who have applied for my EIN. I assume I will get it soon. Having it what am I supposed to do next. Ok, I know I have to go to my Merch account and update the tax form, but I am wondering in which way will got the questions in that interview. When I correctly answer the question that I am NOT US citizen will I be questioned about EIN number? What if not? So my hard “earning” and paid EIN may be useless or what? Can you help me with this part of process?

Thank you.

All you need to do is what is in the article: enter your new EIN in the tax form and you should be good to go.

Hi,

With the permetion of Neil, can you please post the link of this lady, because I loked for her in fiverr but I didn’t found her, and the most important did you got it and if it works for you.

Thanks

I wasted my money calling IRS, wasted my money hiring an assistant to apply for my EIN. I got it pretty fast. One thing I missed that my country of Serbia has no tax treaty with US. I missed some parts of this article for sure….

Hey Neil,

first of all many thanks for all of your amazing articles in this blog.

I just signed up a merch account some days ago and want to start the business…with the help of merch informer for sure.

With reference to the tax withholding, I´m not sure whether I got it right. I´m German (and live in Germany) and as the picture above shows, the tax withholding rate for Germany is 0%. So does this mean Amazon will “not” withhold those 30% or do I have to go throught the whole process of receiving an EIN as you explained it in this article in order to avoid the tax?

Many thanks in advance for your help!!

Take the tax interview when setting up your Merch account and see what percent withholding they say. If it is zero, you are good to go. Anything above that, I would go through the steps in the article.

Thx for your quick response, Neil!!

It says 0,0%, exactly as on the screenshot above from your Merch account/ Tax status. So everything is fine for me.

Thanks for your help!

Hello. Can I use my friend’s EIN? What’s the implication if there is any?

No. It is used to report on your taxes so you do not want to do this.

Hi Neil

Thanks for this article.

I reviewed the Tax Interview forms and when I select that ‘I have a U.S TIN’ it asks “Is your Royalty income effectively connected with a U.S. trade or business?” I need to select YES for the EIN text field to show up. But the thing is, when I select YES, it asks me for my US Business Address and if I select NO, it asks for my ITIN or SSN number.

Please advise. Thanks

I have the same exact the same matter … have you solved this issue?

Hi Neil

I am from India and the withholding rate is 15% (have gone through the Tax Interview). Can I still get an EIN and further reduce it to 0%?

Thanks

So if my country isn’t in that list it will be useless for me to call IRS ?

I would go ahead and give it a shot as the image in the article is not ALL the countries.

What if I am absolutely sure my country isn’t part of the treaty/isn’t in the official list? Getting an EIN in my case still won’t lower the 30% withholding rate?

That is correct.

Hello, i’m non-us however, i have my EIN number but now on merch by amazon there’s no option to add EIN what i can do?.

Thanks.

Once you have your EIN, you will need to take the tax interview over again and enter it in there.

i just got my EIN number but i have trouble submiting the tax interview should i go with the individual or company ?

It depends on what you got the EIN for. Was it for your name? If so, then individual.

Hey, I called the IRS and the agent was really nice. I got the EIN as a sole proprietor and the problem comes when I try to fill it on Amazon TAX interview. they don’t accept an individual to put an EIN and Amazon requires us to select business and then to choose the beneficial owner and I’m confused which one should I select as these are the options available:

Corporation

Estate

Government

International organization

Central bank of issue

Tax-exempt organization

Private foundation

Complex trust

Simple trust

Grantor trust

Partnership

Disregarded entity

Can you please help me Neil? Thank you

It depends on what you got the EIN for. If it is for an individual, I might email Amazon first and ask them.

Hello Neil,

when we update our tax information, what about the withholding amout they cut from my royalties before ? i can ask them for that ? or i can not.

Regards

There is a form that you can fill out if you a non resident alien to get money back that you overpaid. You can find more info about that here: https://www.irs.gov/forms-pubs/about-form-1040-nr

i’m a non us seller if i got the ein do i have to pay taxes in the end of the year or no

You will need to pay your taxes no matter where you live. I would talk with a tax professional.

I’M A NON US SELLER CAN I USE MY FRIEND’S SSN ?

No. This would be tax fraud.

Am I going to talk to a real assistant ?

Cory, the example you use, would still have to pay taxes on income earned from selling on Amazon, regardless if he saved the 10% withholding tax if he registered in Portugal. You don’t make this (obvious) point clear. Also, this and your other article on another site have spelling errors (you say you are not a layer, when you mean lawyer; at the top of this one you say if you are not an America, when you mean American). Anyway, thanks for the information.

Hi Neil,

I’m from India and I’ve been able to reduce it to 15% using my local tax number. Can I further reduce it to a 0% by getting an EIN?

Thanks a ton for this informative article.

I have the same problem. Have you figure this out?

I am from India. How do I get the EIN or ITIn?

Hi Neil,

I am Nonresident Alien of US, I have a Single-Member US LLC.

I was signing up amazon merch on demand, it said that I can not use the EIN of single MBR LLC.

And I don’t have ITIN yet. Can I pay tax by my LLC?