How To Calculate The Costs Of Your Merch By Amazon Business: Delivery, Royalties, Taxes And More

Globally, around two billion t-shirts are estimated to be sold each year. This spells opportunity even to the inexperienced entrepreneur. Naturally, you too, can join in on the t-shirt craze if you signup for Merch by Amazon.

But while the thought of royalties may be what keeps you motivated, there are also costs that you must be aware of.

This post will discuss the expenditures associated with a typical Merch by Amazon business. It will also teach you how to calculate the costs vs royalties ratio, so that you stay afloat no matter what.

What Are The Main Costs Associated With Merch by Amazon?

Although you’ll be able to earn between 13.8% and 37.6% in royalties, depending on how you price your t-shirt, other costs are subtracted from the royalty price. It is this important calculation that will give you the final amount you’ll walk away with in your bank account.

According to Amazon, some of the costs that are factored in include:

- Materials

- Production

- Fulfilment

- Customer service

- Returns

- Exchanges

- Resources required to detect and prevent fraud

When looking at the fulfilment costs, these have a further associated cost that accompany them. They include picking and packing the product when ordered by a customer, as well as shipping.

Shipping includes both Amazon Prime and Free Shipping eligible options.

Since Merch by Amazon is available on several global marketplaces including Europe and Japan, it’s also important to realize that the purchase price that appears on the product detail page is inclusive of taxes or value added tax (VAT). To remind our readers outside of the European Union (EU), VAT is a type of tax on consumer expenditure that’s charged and collected for goods sold between EU countries. Meanwhile, for the US, the purchase includes taxes that are calculated and added at the checkout.

What Is The Reason These Costs Exist And Why Keep Them In Mind?

Just like any brick-and-mortar store, e-commerce businesses or online Sellers are required to pay taxes by law. And as an online t-shirt Seller, you are considered a business by the government. As a result, you’ll be required to pay taxes on every item sold.

From the government’s point of view, taxes are collected to contribute to the national budget. From Amazon’s point of view, taxes are collected to comply with their legal obligations as a business. In addition to this, as a Seller, these taxes must be kept in mind if you would like to calculate your profits from selling t-shirts more accurately.

But this raises some questions. What is the applicable VAT rate for various markets and how is it calculated? One example of this is Germany. The VAT rate for apparel shipped to this country is 19%. Meanwhile, for the UK the VAT rate is 20% (excluding young children’s clothing).

So, once you have established what the VAT rate is, how does this impact your royalties? Again, this depends on your location. For instance, if you have a buyer in Europe, the purchase price will automatically be inclusive of VAT. However, if you’re in the US marketplace, the taxes on the purchase price will not be taken into account when calculating a Seller’s royalty. Instead, the royalty is calculated on the net price which is the purchase price minus the applicable VAT.

This means that some Sellers will sometimes see a different royalty amount than they expect. The reason for this is that Merch by Amazon royalties are “based on the price a customer pays for a product rather than the list price displayed in the Merch by Amazon portal”.

But what is the difference between the purchase price and the list price? The latter is the price entered in the Merch by Amazon portal. The former is the price at which a Seller’s product is sold on Amazon.

There are cases when a product may sell at a price different to the list price. Interestingly enough, Amazon sets the purchase price, and this cannot be adjusted by the Seller. You can, however, change the list price of products at any time.

Laying Out The Math

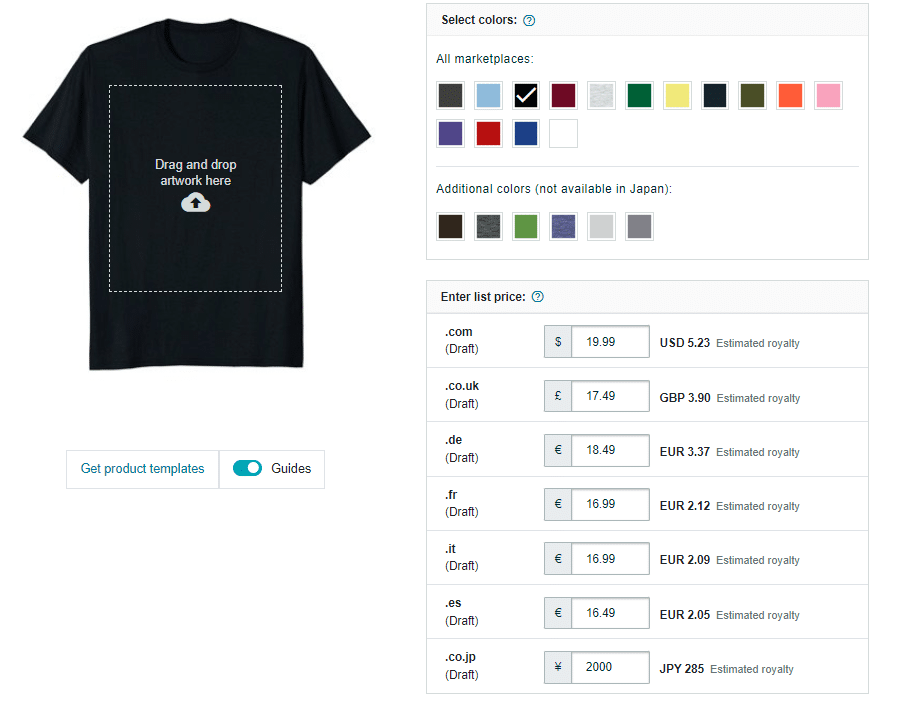

Any seasoned Merch by Amazon Seller will tell you that t-shirts and hoodies are the top-selling merch on the platform. So, with this in mind, we’ll take a look at some examples of royalties that can be earned through standard t-shirts. Again, royalties will depend on the marketplace that you’re selling in and as an example, we’ll select the United States as it is the biggest one.

Remember our discussion above about the differences between the list price and the purchase price? Well, this comes in strong with our example. For instance, it doesn’t matter what your list price is, the most important factor for calculating royalties will be the final purchase price.

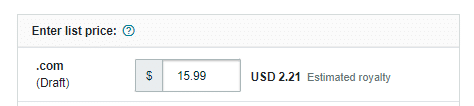

For a standard t-shirt in the US marketplace with a purchase price of $15.99, the royalty will be $2.21.

This climbs up to:

- $3.72 for t-shirts priced at $17.99

- $5.23 for t-shirts priced at $19.99

- $6.74 for t-shirts priced at $21.99

- $8.25 for those going at $23.99

- and $9.77 for t-shirts priced at $25.99

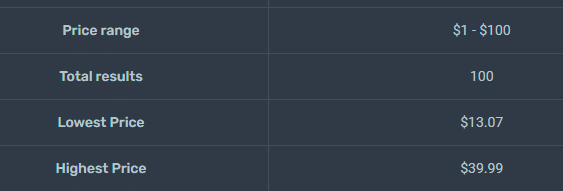

While most Sellers would want to go for the highest royalty rate and price their t-shirts at $25.99, this is simply not feasible for everyone. In fact, it’s important to consider the lowest price, highest price, and average price for t-shirts as a whole in the category or niche you’re selling in order to be competitive.

Outlining The ROI

Now to put all the above into practice. Let’s say we have Seller A and Seller B who sell items that are neither returned, cancelled, nor exchanged.

Seller A sells their t-shirts to the US marketplace at $15.99. Because of their lower price, they attract more sales. This means they’re likely to get royalties in the region of $53.04 for 24 t-shirts sold in a month. All this minus the costs of fulfilment and shipping – and again, this will depend on whether the customer is using Amazon Prime or Free Shipping.

Seller B, on the other hand, sells their t-shirts at the higher end of the spectrum at $25.99. However, they only make around 12 sales for the month. By calculating the royalties without including fulfilment and shipping costs, this Seller is likely to earn around $117.24.

It seems clear cut that Seller B is raking in the higher royalties. But what must be mentioned is that once VAT is added, as are shipping, materials, and fulfillment costs, the royalty amount declines.

Sellers, therefore, need to find that sweet spot in order to maximize their offering. Also to be factored in include the fact that by selling higher quantities of t-shirts on the US marketplace, a Seller can still make higher profits by offering their products at a lower price. The opposite is also true. By selling fewer quantities but at a higher price, the Seller can still make up the balance in terms of royalties earned.

There is no rigid formula to follow. It’s all about the shirt’s design and the balance of the selling price versus all the other costs involved. This may involve an element of trial and error as you become more familiar with the platform over time as well as customer demand.

In Conclusion

Calculating the profits from your Merch by Amazon business can appear tricky. However, it’s not impossible, if you apply the right pricing strategy.

That is, if you take into account the marketplace you’re selling in, as well as the pricing of your items – whether these be t-shirts, hoodies, sweatshirts, or something else.

And finally, once all that’s been said and done, you’ll want to know how and when you’ll get paid. As a rule of thumb, Amazon will pay royalties on the month following the month during which royalties were accrued in an account nominated by you.